Green Finance Strategy

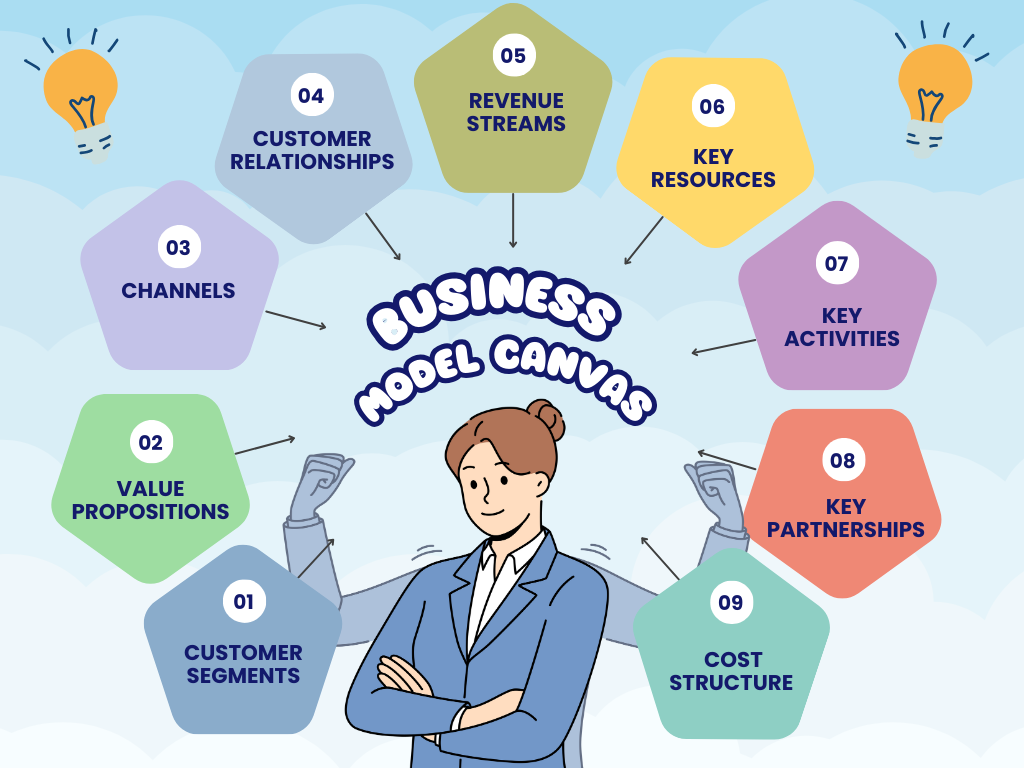

The Business Model Canvas (BMC) is a strategic tool that can effectively structure a green finance strategy by aligning each component with sustainability goals. Here's how each of the nine BMC components can be applied:

1. Customer Segments

• Target Audiences: Identify stakeholders such as eco-conscious investors, businesses seeking green project funding, governments, NGOs, and retail customers interested in sustainable banking.

• Example: A green bank might target renewable energy startups or municipalities issuing green bonds for infrastructure.

Strategy Tip: Understand which customer segments have the highest demand for sustainable investments and tailor your financial offerings to those segments.

2. Value Propositions

• Sustainability-Driven Benefits: Offer financial products (e.g., green bonds, ESG-linked loans) that provide competitive returns tied to environmental performance, lower interest rates for achieving sustainability targets, or carbon credit trading platforms.

• Example: A "green mortgage" with reduced rates for energy-efficient homes.

Strategy Tip: Focus on delivering both financial returns and environmental benefits. Use the growing interest in sustainability to highlight how your offerings provide a competitive edge.

3. Channels

• Distribution Pathways: Utilize digital platforms for accessibility, partner with eco-friendly organizations, or integrate into existing financial institutions with green divisions.

• Example: A mobile app offering real-time impact metrics for sustainable investments.

Strategy Tip: Leverage digital platforms, ESG rating agencies, and sustainability events to educate and engage customers in green finance options.

4. Customer Relationships

• Trust and Transparency: Build trust through regular environmental impact reports, personalized advisory services, and engagement via sustainability workshops.

• Example: Annual sustainability reports detailing CO2 reduction from funded projects.

Strategy Tip: Develop customer education programs, sustainability reports, and transparency practices that foster trust in your green finance offerings.

5. Revenue Streams

• Eco-Aligned Income: Generate revenue via green loan interest, management fees for sustainable funds, or success fees based on environmental milestones.

• Example: A fee structure where 1% of assets under management supports reforestation projects.

Strategy Tip: Identify how much value sustainable finance will create and determine your pricing and revenue generation models around those green outcomes.

6. Key Resources

• Strategic Assets: Leverage expertise in environmental policy, partnerships with ESG rating agencies, access to green databases, and certifications (e.g., Climate Bonds Initiative).

• Example: Hiring sustainability analysts to assess project viability.

Strategy Tip: Build the internal capacity to measure and monitor your finance offerings' environmental and social performance. This includes investing in technologies that help track green outcomes.

7. Key Activities

• Core Operations: Develop green financial products, conduct environmental risk assessments, measure impact metrics, and advocate policy.

• Example: Creating a framework for evaluating solar farm investments using ESG criteria.

Strategy Tip: Focus on creating a streamlined process for assessing, approving, and monitoring green finance products. Build partnerships to expand the reach of your green finance initiatives.

8. Key Partnerships

• Collaborative Networks: Partner with NGOs, regulatory bodies, green tech firms, auditors (e.g., CDP), and academic institutions for R&D.

• Example: Collaborating with a climate NGO to certify green bonds.

Strategy Tip: Create partnerships with environmental regulators, green certification bodies, and sustainability-focused investors to amplify the impact and credibility of your green finance products.

9. Cost Structure

• Financial Considerations: Account for costs of green certifications, due diligence on sustainable projects, impact reporting, and marketing. Balance with long-term savings from resilient investments.

• Example: Higher upfront costs for vetting wind energy projects, offset by government green subsidies.

Strategy Tip: While the upfront costs (due diligence, certifications) might be higher, the long-term value from attracting sustainability-conscious investors and meeting regulatory demands can outweigh these costs.

Outcome

The BMC provides a holistic view, enabling organizations to design an environmentally impactful and economically viable green finance strategy while mitigating risks like greenwashing through transparency and measurable outcomes. From designing products that meet environmental standards to engaging customers in meaningful ways, the BMC allows you to create a comprehensive framework for a green finance strategy. Make sure to iterate on your model as market needs evolve, keeping sustainability at the core of your financial offerings.

Read the articles below for more understanding about the topic.

The Sustainable Business Model Canvas

A SHORT GUIDE TO DEVELOPING GREEN BUSINESS MODELS

Green business model canvas: a framework for sustainable business practice